IMPORTANT NOTICE

Beware of a scam where IPPFA, including our representative's individual profile, has been impersonated to scam consumers with fast-returns investment schemes.

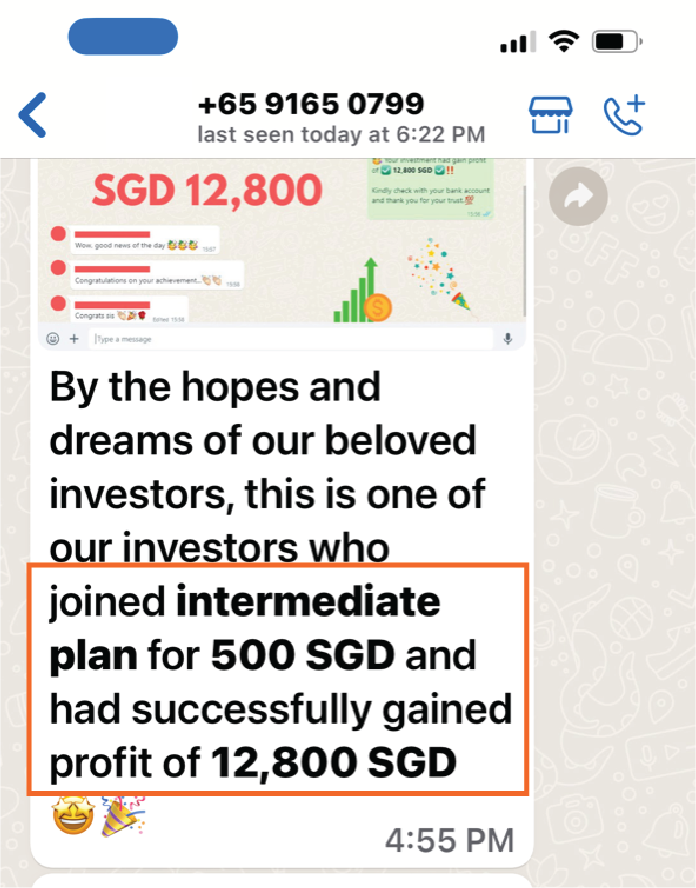

A scam on Facebook promises quick (within 12 hours) and substantial returns (3 times the investment amount) for a small investment amount (e.g. $300), but will ask for more money to withdraw any capital and profits.

IPPFA Licence

IPPFA is primarily licenced by MAS to market and distribute life insurance products and collective investment schemes (more commonly known as unit trusts) under the Financial Advisers Act. Under our licence we do not collect cash. The details of our licence are available here.

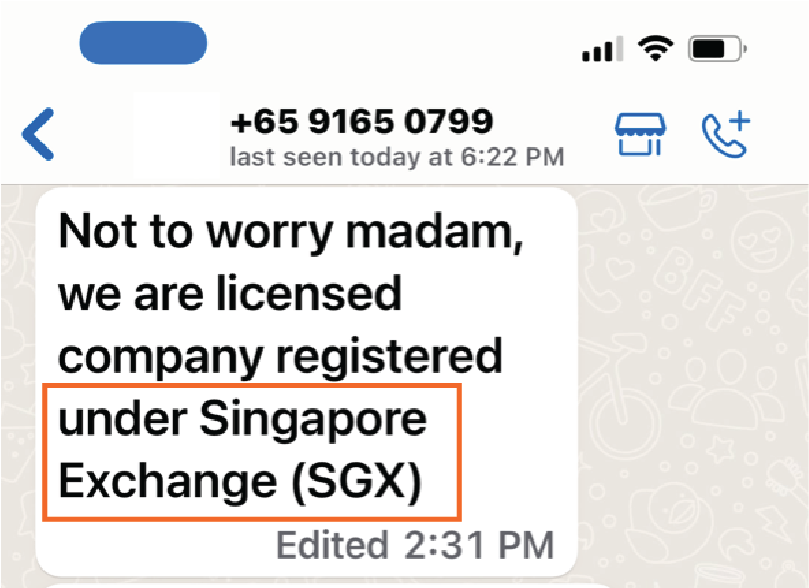

We do not hold any capital market service (“CMS”) licence under the Security Financial Act and are not listed in the Singapore Exchange. We do not conduct any fund management activities except restricted fund management activities (under the registered fund manager framework) for Accredited Investors only. Any entity, including public listed entities, will need to have a CMS licence to conduct fund management activities.

IPPFA Sales Advisory Process

Licenced Financial Advisers (“FA”) are required to conduct fact-finding and financial needs analysis before making any recommendations to customers. FAs only help customers place their investments to insurance companies or through investment platform(s) to fund managers.

We do not collect any money directly from customers. Customers need to go through an onboarding process, and after successful onboarding payment is made directly to authorized providers only.

Advisory Note

Consumers and investors are advised not to participate in investment schemes that sound too good to be true. You should be suspicious when a large amount of money (more than $500) is requested. No financial institution in Singapore can collect money without an onboarding process. You are advised to check with the organization before making any transfer of money. Learn how to identify the techniques used by illegitimate scammers here.

THINGS TO LOOK OUT FOR

IPP Financial Advisers Pte Ltd is not registered under SGX and we do not deal with trading, share capital or quick returns investment schemes.

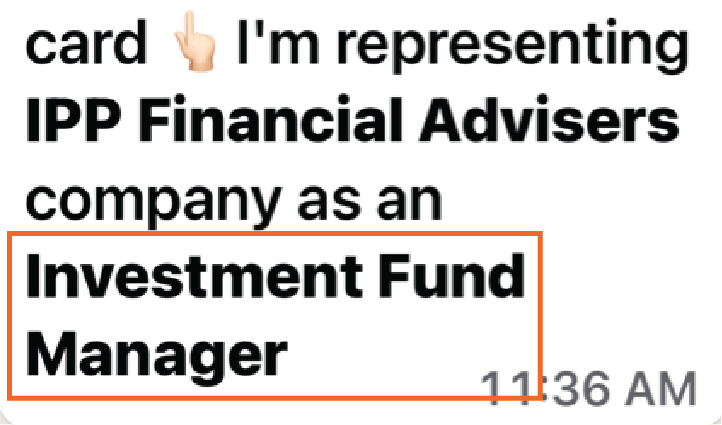

Our representatives will never identify as fund managers.

Our representatives will never reach out to our clients or consumers to transfer money (via PAYnow or internet banking transfer) to individual accounts.

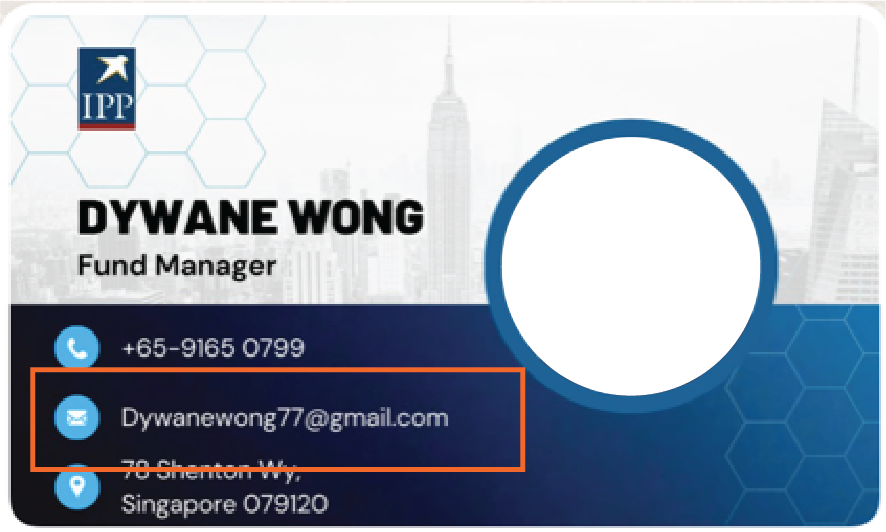

Our representatives will only correspond using our official email address ending with @ippfa.com.

FAQ

Q: How can I verify if the person contacting me is from IPPFA?

Please search the name or MAS registration number of our representative in our registry here. If you cannot find the person on the MAS registry, it is most likely someone that is impersonating one of our representatives.

Q: I have received an email providing me information on the investments, is it real?

All communications from our representatives will be from an email address that ends with @ippfa.com. If it does not, it is most likely a scam.

Q: I have been asked to send money to secure my investment, can I do it?

IPPFA does not handle cash or hold money on behalf of customers. Our representatives will not request payment to any personal bank account / Paynow / Paylah. All payments, if any, are made directly with the insurers or Investment Platforms (for CIS) that you have purchased through us. In addition, our representatives are required to conduct fact-finding and financial needs analysis before making any recommendation in written form to you. If your sale process experience differs from the above, the person you are dealing with is likely NOT one of our appointed representatives.

Q: I have sent money to the scammer. What should I do?

Please make a police report immediately and the police can advise on the next steps. Police reports can be filed here.

Online Survey | Privacy Policy | Data Protection | Fair Dealing | Our Licence | Disclaimer | Complaints Handling and Resolution Process

IPP Financial Advisers Private Limited. FWD Group Limited holds a minority interest in IPPFA. All rights reserved. Website by IPPFA Company Registration Number: R1983-04992C. Licensed under the Financial Advisers Act, Singapore.

CONFIDENTIAL NOTE: The information contained in this website is intended only for the use of the individual or entity named above and may contain information that is privileged, confidential and exempt from disclosure under applicable law. Click here to view our privacy policy. Website by IPPFA Webmaster